Homeowners Insurance in and around Chesterfield

Looking for homeowners insurance in Chesterfield?

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Would you like to create a personalized homeowners quote?

Welcome Home, With State Farm Insurance

Your home is a special place. You need homeowners coverage to keep it safe! You’ll get that with homeowners insurance from State Farm, the leading provider of homeowners insurance. State Farm Agent Wes Kuhn is your reliable authority who can offer an insurance policy personalized for your specific needs.

Looking for homeowners insurance in Chesterfield?

The most important parts of a home are the people you share it with... and the State Farm insurance that covers it.

Homeowners Insurance You Can Trust

From your home to your precious pictures, State Farm is here to make sure your valuables are covered. Wes Kuhn would love to help you know what insurance fits your needs.

Whether you're prepared for it or not, the unforeseen can happen. But with State Farm, you're always prepared, so you can kick off your shoes knowing that your belongings are secure. Additionally, if you also insure your SUV, you could bundle and save! Contact agent Wes Kuhn today to go over your options.

Have More Questions About Homeowners Insurance?

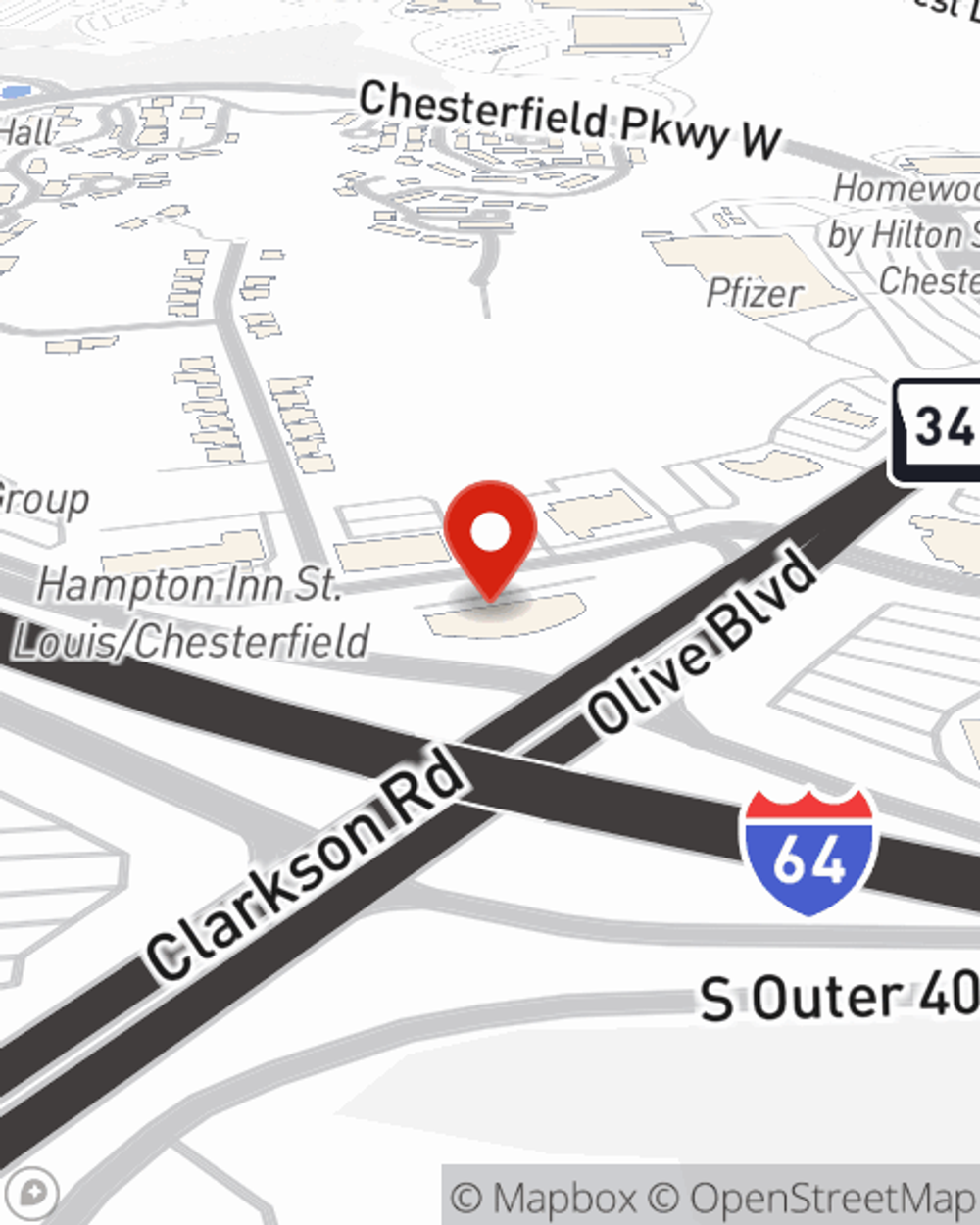

Call Wes at (636) 220-3680 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

How to be environmentally friendly at home and save on energy bills

How to be environmentally friendly at home and save on energy bills

Whether you’re looking to save some money or make changes for more environmentally friendly living, these tips may help.

Simple Insights®

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

How to be environmentally friendly at home and save on energy bills

How to be environmentally friendly at home and save on energy bills

Whether you’re looking to save some money or make changes for more environmentally friendly living, these tips may help.